Great Throughts Treasury

This site is dedicated to the memory of Dr. Alan William Smolowe who gave birth to the creation of this database.

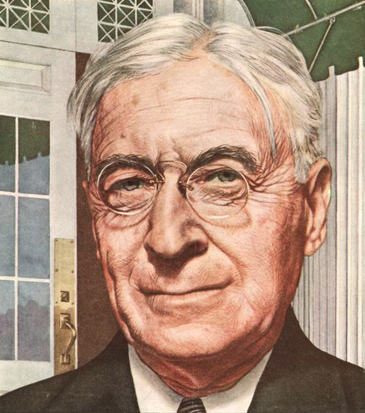

Bernard Baruch, fully Bernard Mannes Baruch

American Businessman, Statesman, Advisor to U.S. Presidents

"The art of living lies less in eliminating our troubles than in growing with them."

"Take the profit out of war."

"Let this be anchored in our minds: Peace is never long preserved by weight of metal or by an armament race. Peace can be made tranquil and secure only by understanding and agreement fortified by sanctions. We must embrace international cooperation or international disintegration."

"During my eighty-seven years I have witnessed a whole succession of technological revolutions. But none of them has done away with the need for character in the individual or the ability to think."

"Let us not deceive ourselves; we must elect world peace or world destruction."

"A political leader must keep looking over his shoulder all the time to see if the boys are still there. If they aren't still there, he's no longer a political leader."

"Every man has a right to his opinion, but no man has a right to be wrong in his facts."

"Government is not a substitute for people, but simply an instrument through which they act. And if the individual fails to do his duty as a citizen, government becomes a very deadly instrument."

"In the last analysis, our only freedom is the freedom to discipline ourselves."

"Recipe for success: Be polite, prepare yourself for whatever you are asked to do, keep yourself tidy, be cheerful, don't be envious, be honest with yourself so you will be honest with others, be helpful, interest yourself in your job, don't pity yourself, be quick to praise, be loyal to your friends, avoid prejudices, be independent, interest yourself in politics, and read the newspapers."

"There are no such things as incurables; there are only things for which man has not found a cure."

"There is no more dangerous misconception than this which misconstrues the arms race as the cause rather than a symptom of the tensions and divisions which threaten nuclear war. If the history of the past fifty years teaches us anything, it is that peace does not follow disarmament - disarmament follows peace."

"Unless each man produces more than he receives, increases his output, there will be less for him and all the others."

"We didn't all come over on the same ship, but we're all in the same boat."

"We must remember that the people do not belong to the government but that governments belong to the peoples."

"Whatever task you undertake, do it with all your heart and soul. Always be courteous, never be discouraged. Beware of him who promises something for nothing. Do not blame anybody for your mistakes and failures. Do not look for approval except the consciousness of doing your best."

"One of the secrets of a long and fruitful life is to forgive everybody everything every night before you go to bed."

"10 Rules of Investing: 1. Don?t speculate unless you can make it a full-time job. 2. Beware of barbers, beauticians, waiters ? of anyone ? bringing gifts of ?inside? information or ?tips.? 3. Before you buy a security, find out everything you can about the company, its management and competitors, its earnings and possibilities for growth. 4. Don?t try to buy at the bottom and sell at the top. This can?t be done ? except by liars. 5. Learn how to take your losses quickly and cleanly. Don?t expect to be right all the time. If you have made a mistake, cut your losses as quickly as possible. 6. Don?t buy too many different securities. Better have only a few investments which can be watched. 7. Make a periodic reappraisal of all your investments to see whether changing developments have altered their prospects. 8. Study your tax position to know when you can sell to greatest advantage. 9. Always keep a good part of your capital in a cash reserve. Never invest all your funds. 10. Don?t try to be a jack of all investments. Stick to the field you know best."

"A dangerous fallacy is to repudiate freedom in favor of an unknown future. What else but our own sturdy reliance on freedom can explain the unexampled record this country has made? In a period scarcely twice my own lifetime it has risen from nothingness to become the world's greatest power. It has become the ark of the covenant of freedom."

"A man can't retire his experience. He must use it. Experience achieves more with less energy and time."

"A man sentenced to death obtained a reprieve by assuring the king he would teach his majesty's horse to fly within the year - on the condition that if he didn't succeed, he would be put to death at the end of the year. "Within a year," the man explained later, "the king may die, or I may die, or the horse may die. Furthermore, in a year, who knows? Maybe the horse will learn to fly." My philosophy is like that man's. I take the long-range view."

"A speculator is a man who observes the future, and acts before it occurs."

"Age is only a number, a cipher for the records. A man can't retire his experience. He must use it. Experience achieves more with less energy and time."

"Agriculture is the greatest and fundamentally the most important of our industries. The cities are but the branches of the tree of national life, the roots of which go deeply into the land. We all flourish or decline with the farmer."

"Although the shooting war is over, we are in the midst of a cold war which is getting warmer."

"Always do one thing less than you think you can do."

"America has never forgotten - and never will forget - the nobler things that brought her into being and that light her path - the path that was entered upon only one hundred and fifty years ago ... How young she is! It will be centuries before she will adopt that maturity of custom - the clothing of the grave - that some people believe she is already fitted for."

"Approach each new problem not with a view of finding what you hope will be there, but to get the truth, the realities that must be grappled with. You may not like what you find. In that case you are entitled to try to change it. But do not deceive yourself as to what you do find to be the facts of the situation."

"Be who you are and say what you feel, because those who mind don't matter and those who matter don't mind."

"Bears don't live on Park Avenue."

"Behind the black portent of the new atomic age lies a hope which, seized upon with faith, can work out salvation. . . . Let us not deceive ourselves: we must elect world peace or world destruction."

"Chance sometimes opens the door, but luck belongs to the good players."

"Creativity: Take the obvious, add a cupful of brains, a generous pinch of imagination, a bucketful of courage and daring, stir well and bring to a boil."

"Do not blame anybody for your mistakes and failures."

"Do not look for approval except for the consciousness of doing your best."

"Don't try to buy at the bottom and sell at the top. It can't be done except by liars."

"Even when we know what is right, too often we fail to act. More often we grab greedily for the day, letting tomorrow bring what it will, putting off the unpleasant and unpopular."

"Get to know yourself. Know your own failings, passions, and prejudices so you can separate them from what you see. Know also when you actually have thought through to the nature of the thing with which you are dealing and when you are not thinking at all... Knowing yourself and knowing the facts, you can judge whether you can change the situation so it is more to your liking. If you cannot--or if you do not know how to improve on things--then discipline yourself to the adjustments that will be necessary."

"Gold has worked down from Alexander's time ... When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory."

"I am interested in physical medicine because my father was. I am interested in medical research because I believe in it. I am interested in arthritis because I have it."

"I am quite sure that in the hereafter she will take me by the hand and lead me to my proper seat."

"I get the facts, I study them patiently, I apply imagination."

"I have known men who could see through the motivations of others with the skill of a clairvoyant; only to prove blind to their own mistakes. I have been one of those men."

"I have learned the truth of the observation that the more one approaches great men the more one finds that they are men."

"I made my money by selling too soon."

"I never lost money by turning a profit."

"I was eleven, then I was sixteen. Though no honors came my way, those were the lovely years."

"I was the son of an immigrant. I experienced bigotry, intolerance and prejudice, even as so many of you have. Instead of allowing these thing to embitter me, I took them as spurs to more strenuous effort. ."

"I will never be an old man. To me, old age is always fifteen years older than I am."

"I?m not smart. I try to observe. Millions saw the apple fall but Newton was the one who asked why."