Great Throughts Treasury

This site is dedicated to the memory of Dr. Alan William Smolowe who gave birth to the creation of this database.

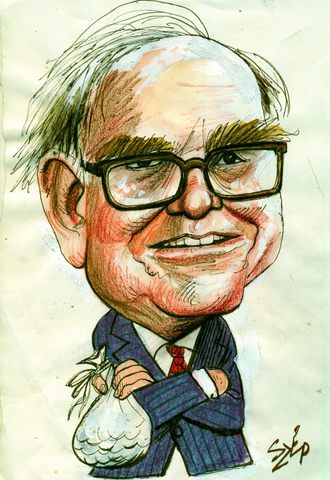

Warren Buffett, fully Warren Edward Buffett, aka Oracle of Omaha

American Businessman, Investor and Philanthropist, Chairman and CEO of Berkshire Hathaway

"I have pledged – to you, the rating agencies and myself – to always run Berkshire with more than ample cash. We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits."

"I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business. I do it because I like this kind of life."

"I just think that - when a country needs more income and we do, we're only taking in 15 percent of GDP, I mean, that - that - when a country needs more income, they should get it from the people that have it."

"I just don't see anything available that gives any reasonable hope of delivering such a good year and I have no desire to grope around, hoping to 'get lucky' with other people's money. I am not attuned to this market environment, and I don't want to spoil a decent record by trying to play a game I don't understand just so I can go out a hero."

"I need all the help I can get -- and Ken has certainly provided it,"

"I made my first investment at age eleven. I was wasting my life up until then."

"I like to go for cinches. I like to shoot fish in a barrel. But I like to do it after the water has run out."

"I never buy anything unless I can fill out on a piece of paper my reasons. I may be wrong, but I would know the answer to that. “I’m paying $32 billion today for the Coca Cola Company because...” If you can’t answer that question, you shouldn’t buy it. If you can answer that question, and you do it a few times, you’ll make a lot of money."

"I never attempt to make money on the stock market. I buy on assumption they could close the market the next day and not re-open it for five years."

"I personally would increase the taxable base above the present ninety thousand. I pay very, very little in the way of social security taxes because I make a lot more than ninety thousand and the people in my office pay the full tax."

"I personally think it would be better if the NYSE remained as a neutral, not-for-big-profit institution. The exchange has done a very good job over the centuries. It's one of the most important institutions in the world. The enemy of investment is activity.... I know the American investor will not be better off if volume doubles on the NYSE, and I know the NYSE will be trying to figure out how to do that if it is trying to maximize its own earnings per share. GM or IBM will not earn more money if their stock turns over more actively, but a for-profit NYSE will."

"I recently sold a house in Laguna for $3.5 million. It was on about 2,000 square feet of land, maybe a twentieth of an acre, and the house might cost about $500,000 if you wanted to replace it. So the land sold for something like $60 million an acre."

"I think you'll know what they will do and won't do, ... More companies ought to do that."

"I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will."

"I really like my life. I’ve arranged my life so that I can do what I want."

"I violated the Noah rule: Predicting rain doesn't count; building arks does."

"I think it is a marvelous way to keep directors' interests and shareholders interests as closely aligned as possible, with both an upside and a downside component. Too often, people talk about interests being aligned when the directors get the upside and shareholders get the downside."

"I was hoping you'd tell me."

"I want to give my kids enough so that they could feel that they could do anything, but not so much that they could do nothing."

"I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side…Now for that same cube of gold, it would be worth at today’s market prices about $7 trillion – that’s probably about a third of the value of all the stocks in the United States…For $7 trillion…you could have all the farmland in the United States, you could have about seven Exxon Mobils (NYSE:XOM) and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils."

"I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful."

"I won't close down a business of subnormal profitability merely to add a fraction of a point to our corporate returns. I also feel it inappropriate for even an exceptionally profitable company to fund an operation once it appears to have unending losses in prospect. Adam Smith would disagree with my first proposition and Karl Marx would disagree with my second; the middle ground is the only position that leaves me comfortable."

"I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy."

"I’d be a bum on the street with a tin cup if the markets were always efficient."

"I wouldn't mind going to jail if I had three cellmates who played bridge."

"I’ve reluctantly discarded the notion of my continuing to manage the portfolio after my death – abandoning my hope to give new meaning to the term ‘thinking outside the box.’"

"I’ve never swung at a ball while it’s still in the pitcher’s glove."

"If anything, taxes for the lower and middle class and maybe even the upper middle class should even probably be cut further. But I think that people at the high end - people like myself - should be paying a lot more in taxes. We have it better than we've ever had it."

"If a business does well, the stock eventually follows."

"I’ve seen more people fail because of liquor and leverage – leverage being borrowed money. You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing."

"If at first you do succeed, quit trying on investing."

"I'd be a bum on the street with a tin cup if the markets were efficient."

"If California has troubles, the country has troubles."

"If calculus or algebra were required to be a great investor, I’d have to go back to delivering newspapers."

"If Corporate America is serious about reforming itself, CEO pay remains the acid test... The results aren't encouraging."

"If past history was all there was to the game, the richest people would be librarians."

"If I was running $1 million today, or $10 million for that matter, I'd be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I've ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It's a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that."

"If someone starts talking to you about beta, zip up your pocketbook."

"If we can’t find things within our circle of competence, we don’t expand the circle. We’ll wait."

"If you have a harem of 40 women, you never get to know any of them very well."

"If you understood a business perfectly and the future of the business, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger margin of safety you'd need. If you're driving a truck across a bridge that says it holds 10,000 pounds and you've got a 9,800 pound vehicle, if the bridge is 6 inches above the crevice it covers, you may feel okay, but if it's over the Grand Canyon, you may feel you want a little larger margin of safety."

"If you’re an investor, you’re looking on what the asset is going to do, if you’re a speculator, you’re commonly focusing on, what the price of the object is going to do, and that’s not our game."

"If you buy things you do not need, soon you will have to sell things you need."

"If you are in a poker game and after 20 minutes you don't know who the patsy is, then you’re the patsy."

"If something is not worth doing at all, it's not worth doing well."

"If you don't feel comfortable owning something for 10 years, then don't own it for 10 minutes."

"If you don't know jewelry, know the jeweler."

"If you have a great manager, you want to pay him very well."

"If you expect to continue to purchase stocks throughout your life, you should welcome price declines as a way to add stocks more cheaply to your portfolio."

"If you’re in the luckiest 1 per cent of humanity, you owe it to the rest of humanity to think about the other 99 per cent."